F&I Training, Software Solutions, and Profit Participation Programs

Providing you the best tools to serve your clients.

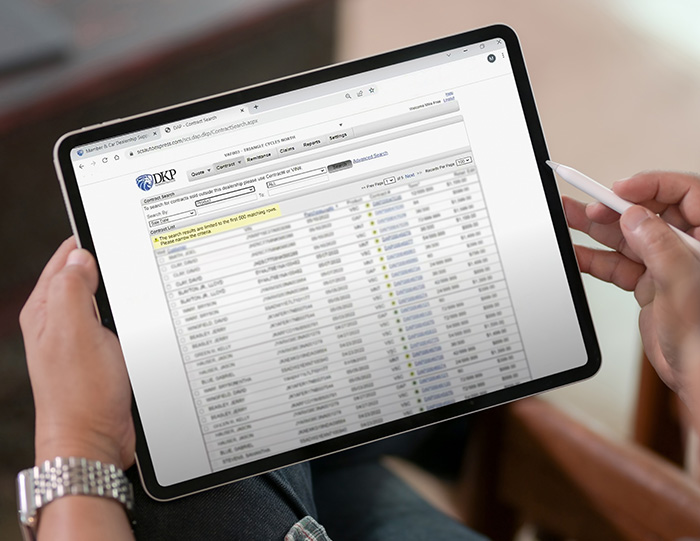

Your business is unique — and so are your customers’ needs. That’s why DKP takes a custom approach to develop and manage your new or pre-owned car, RV, or power sports dealership. We provide F&I staff training, software solutions, and vehicle protection products designed especially for each dealer, lender, and agent we serve.

DKP F&I Training

The F&I Manager will learn skills to improve productivity and profitability in the F&I Department while ensuring compliance with every transaction.

In this class, the DKP instructor will develop the following skills:

- Establishing an F&I process and culture

- Conducting an effective customer interview

- Working efficiently with lenders

- Driving profitability and compliance

- Conducting effective product presentations

- Menu presentation techniques

- Objection handling techniques

- Proven role-play experience

Profit Participation Programs

DKP’s profit participation programs allow dealers, lenders, and agents to:

- Establish their own insurance companies for maximum profitability and tax benefits, or…

- Earn a percentage of underwriting profits without assuming risk.

By directing all or part of the premiums generated from protection products back into their businesses, our clients are better positioned to build wealth and long term.

Reinsurance and retrospective agreements

Which one is right for you?

While the term “reinsurance” is commonly used to refer to both reinsurance and retrospective structures, it’s important to understand the difference. DKP offers multiple profit participation plans:

Reinsurance

The reinsurance concept allows the dealer, lender, or agent to own and control their own insurance company, which accepts premiums generated from vehicle service agreements and other aftermarket products. These companies are known as producer-owned reinsurance companies (PORC) or producer-affiliated reinsurance companies (PARC). The insurance company holds the premium reserves and earns all of the underwriting profits, plus investment income from these premiums. These profits can be withdrawn regularly to provide working capital or create long-term wealth.

Retrospective plans

The retrospective concept allows the dealer, lender, or agent to participate in a portion of the underwriting profits while assuming no risk. The administrator holds the premiums and allows the dealer, lender, or agent to take up to 80 percent of the underwriting profits on scheduled payout dates as long as the portfolio is performing. Unlike a PORC or PARC, there are no annual fees or tax preparation required for a retro agreement.

Contact DKP Administration

If you’d like to learn more about adding our plans to your automotive, RV, or power sports dealership, or have questions about your existing services, please enter your information on this page. A member of our Dealer Support Team will be in touch within one business day.